Homeowners Insurance in and around Ellisville

If walls could talk, Ellisville, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Homeownership is a lot of responsibility. You want to make sure your home and the possessions in it are protected in the event of some unexpected mishap or catastrophe. And you also want to be sure you have liability insurance in case someone gets hurt on your property.

If walls could talk, Ellisville, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Safeguard Your Greatest Asset

Preparing for life's troubles is made easy with State Farm. Here you can personalize your policy or file a claim with the help of agent Andrew Ceriotti. Andrew Ceriotti will make sure you get the attentive, excellent care that you and your home needs.

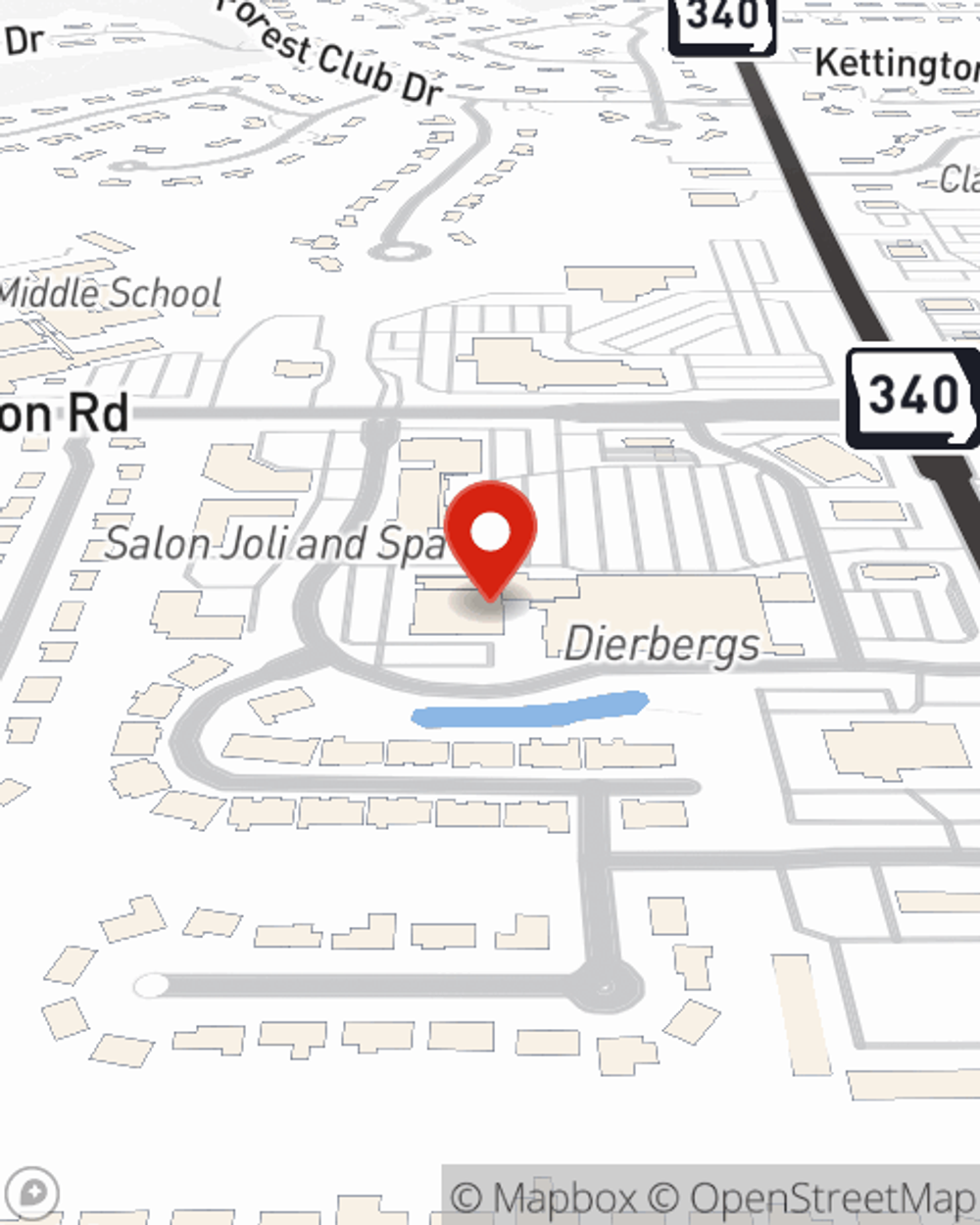

Ellisville, MO, it's time to open the door to dependable coverage. State Farm agent Andrew Ceriotti is here to assist you in exploring your specific options. Visit today!

Have More Questions About Homeowners Insurance?

Call Andrew at (636) 391-6807 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.

Andrew Ceriotti

State Farm® Insurance AgentSimple Insights®

How a storm shelter or safe room can help protect against severe weather

How a storm shelter or safe room can help protect against severe weather

Constructing a storm shelter or safe room space within your home can help protect you from natural disasters and weather emergencies.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.